What are Home Loan EMIs?

EMI or Equated Monthly Instalments can be defined as loan repayment. Home loan EMIs assist debtors repay the borrowed domestic mortgage amount. Using an EMI calculator for domestic loans is advised because it’s a protracted-time period of dedication. Any errors could have a large impact on your economic well-being. In addition, different factors can have an effect on domestic loan EMIs.

You ought not to wait for an eternity to buy your dream residence anywhere. With the help of a housing mortgage at low-cost interest, you can make a premature buy. Factors like income balance, creditworthiness, belongings fee, and MCLR will impact the house loan hobby fee and EMI. So buy or assemble your Wonderland with a housing loan now!

Most folks dream of buying a domestic dwelling fortunately for the relaxation of our lives. However, home fees are skyrocketing in the contemporary generation, and most humans might not have the required money. This does not mean you cannot buy or construct the house of your desires in this US.

Financial institutions can help you purchase or construct the home of your desire with mortgage facilities. You can pay for your dream residence in advance and begin living in it with the help of a housing loan. Some people are a little too worried about the hobby fees related to housing loans.

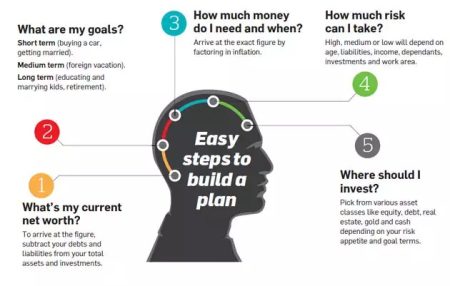

Following are the five factors that impact your home loan. Read directly to recognize the factors impacting India’s housing mortgage EMI and interest quotes.

Comprehending Housing Loans

A domestic mortgage is a secured loan choice furnished via financial establishments. The lender offers you the finances to buy the house but keeps the name deeds. When you fail to return the loan quantity to the lender, the collateral (your private home) covers the costs.

However, housing loans come with cheap hobby charges and flexible tenures, consequently lowering the possibility of default. Opting for a housing loan is lots higher than laborious all your savings and promoting all belongings to buy belongings. Here are the factors affecting your housing loan EMI and interest quotes:

Your Credit Score

Your credit score displays your creditworthiness to the lender. When your credit score rating is bad, it reflects that you have not been paying preceding EMIs well timed.

With a very good credit score the credit score hazard for the lender decreases. When a borrower’s credit score risk is low, the home mortgage hobby price is also low. As the interest fee decreases, the housing loan EMI also decreases.

A housing loan EMI consists of a part of the predominant amount and the hobby rate.

The Market Value of Your Property

The belongings’ resale fee is low whilst it’s miles in a faraway or rural region. On the alternative hand, the resale cost of a property in a top place is generally high. When the property’s marketplace cost is high, the hobby rate on a housing loan is low.

Loan processing rate

The processing rate is another vital determinant of your cost of borrowing. This fee is charged to cowl the executive fees associated with loan processing. It is often a percentage of the loan amount and might vary from one lender to another. The processing charge can affect your EMI, as it’s far added to the loan quantity. It is critical to evaluate processing prices charged by way of numerous creditors and pick out the only one that fits your economic scenario.

Job Stability

Any lender will acquire records concerning your occupation before providing a housing mortgage. When you have an earnings balance, the credit risk is lower. For the equal reason, borrowers with income balance experience cheap interest on housing loans.

Current MCLR

MCLR (Marginal Cost of Funds-primarily based Lending) is a benchmark hobby rate determined by using RBI. An economic group cannot move lower than the contemporary MCLR whilst offering a housing loan.

If the modern MCLR is low, you may experience less expensive interest on a housing loan. As the hobby charge decreases, the EMI quantity will even plummet.

Conclusion

You have to understand the elements controlling your housing loan’s hobby quotes, like process stability, credit score, and MCLR. You can use the home mortgage EMI calculator available online to get an idea of the hobby fees related to your private home mortgage amount. Apply for a mortgage and purchase your dream residence now!

Managing your property loan EMI requires radical know-how of the factors that affect it. It is crucial to select the mortgage amount, hobby fee, mortgage tenure, and processing charge that suit your monetary scenario. You need to additionally not forget prepayment as a way to lessen your EMI and loan tenure. By thinking about those factors, you can manipulate your private home loan EMI effectively and conveniently repay your mortgage. Failing to do so can bring about mismanagement and losses. Defaulting on EMIs will cause a bad credit rating. This, in turn, will affect your credit score records negatively, and also you won’t get pleasant deals in the future.