As more and more people embrace digital currencies, knowing how to cash out cryptocurrency has become a vital part of the crypto landscape. This is because even though cryptocurrencies offer so many benefits, some situations still mean that people need to convert them into conventional fiat currencies. For example, you may need cash to spend with a business where they don’t accept crypto.

In this blog post, we look at some of the ways you can use to cash out cryptocurrency to help you make informed decisions.

Using cryptocurrency ATMs

Cryptocurrency ATMs look similar to the conventional cash dispensing machines that you use to withdraw cash from your bank account. However, these automated machines are not connected to bank accounts but are instead linked with crypto platforms. They are strategically located in high-traffic areas such as airports, malls, and other busy areas.

Pros of crypto ATMs

- User-friendliness – Crypto ATMs have simple interfaces making them easy to use for non-tech-savvy users.

- Convenience – Crypto ATMs enable users to cash out cryptocurrency conveniently as they are located in accessible places, and operate round the clock.

- Anonymity – Some crypto ATMs allow users to liquidate their digital currencies without requiring extensive identity verification

Cons of crypto ATMs

- Geographical limitations – Crypto ATMs are found in limited areas and thus not accessible to all crypto holders.

- High fees –– Automated machines often charge higher fees than other cash-out options.

- Limited cryptos – Crypto ATMs do not support all coins

Using cryptocurrency exchanges

Crypto exchanges are one of the most common ways to cash out cryptocurrency. They offer a friendly option to non-tech-savvy users. This is because there are also physical exchanges where such users can visit and transact. Exchanges offer users a wide variety of coins and liquidity making them a great option for both beginners and experienced crypto traders.

Pros of crypto exchanges

- Liquidity – Due to their high trading volumes traders can execute transactions quickly

- Many payment options – Exchanges have several withdrawal options giving users many options

- Convenience – Most online exchanges have user-friendly interfaces and support multiple coins

Cons of crypto exchanges

- Security – Some exchanges especially the centralized ones are prone to hacking and some security breaches

- Lack of privacy – Many crypto exchanges require users to undergo extensive identity verification which may compromise their privacy

- Fees – Trading platforms have transaction fees, withdrawal fees, and even some hidden charges

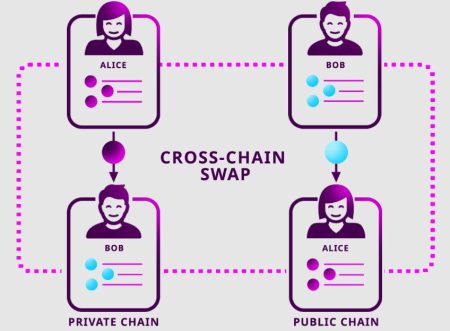

Peer-to-peer (P2P) platforms

These are some platforms that connect buyers and sellers so that they can trade directly with no intermediaries involved. The platforms offer users the freedom to choose their preferred payment methods, and even to agree on the trading terms. In addition, some P2P platforms offer escrow services to protect both buyers and sellers by only releasing funds when each party has done their part of the deal. Common examples of P2P platforms are Paxful and LocalBitcoins.

Pros of P2P platforms

- Negotiation – As you cash out cryptocurrency, you and the buyer can negotiate on the prices

- Payment options – Users can choose among the many payment options because the platforms offer flexibility

- Privacy – P2P platforms often offer a higher level of privacy than crypto exchanges

Cons of P2P platforms

- Lack of regulation – P2P platforms could have no regulatory oversights resulting in legal uncertainties

- Scams – P2P platforms can be at risk of scams and various fraudulent activities

Conclusion

If you have been looking for ways to cash out your cryptocurrency, the above discussion sheds light on some of the common methods you can use. The crucial thing is to consider the one that works best for you and make your decision from an informed perspective.