It will also serve you right to know that your personal savings can be highly enriched by following the economic events and that is where the economic calendar comes in. It provides important events, for example, governmental releases of reports or meetings of the central bank, which may affect your financial context. Therefore, by being informed, you are likely to make appropriate decisions depending on whether you are saving for a specific purchase or just building your savings account.

Indeed, the economic calendar may be helpful to anyone, not only traders or people who work in the financial field. For example, if you are planning to make a serious economic step, such as purchasing a house or starting to save for your children’s college education, the economic calendar helps to make such decisions at the right time when the economy is in a favorable position to help you grow financially.

Why Key Financial Events Matter for Your Savings

So why as a saver, should you care for the economic calendar? It’s simple: the economy impacts personal pockets. With the economy in a constant state of fluctuation, so are the interest rates, inflation, and employment rates that have an influence on the amount of savings. Since these changes are predictable by looking at the economic calendar, you can work towards adjusting your saving plans in consequence.

For instance, if a report has been made showing that the inflation rate is expected to go up, then one has to think of how to invest his/her money in a way that the money can grow beyond the inflation rate, instead of keeping the money in a savings account where it will be depleting its value. That way, instead of just saving money, you’re saving smart, based on the economic events that are occurring around you, thanks to the economic calendar.

Getting the most out of the economic calendar means understanding how to use it effectively. Here are some practical tips:

- You can access economic calendars on various financial news websites, as well as through mobile apps and trading platforms. Look for ones that allow you to customize the information to suit your interests.

- Filter the events by their type or the potential impact they could have on the market. This helps you focus on what’s most relevant to your financial goals.

- Make sure you’re aware of the time zone the calendar uses so you can accurately track when the events will occur in your local time.

Consider this scenario: you’re watching for interest rate changes because you have a savings account whose interest could fluctuate. Here’s how you might use the economic calendar:

- Before an interest rate decision is published, check the calendar to see when this decision will happen.

- Use this information to decide if you should move your money into a different account with a better rate or perhaps invest in bonds, which might benefit from a rate hike.

Strategies for Using the Economic Calendar to Enhance Savings

Knowing when to move your money can be just as important as knowing where to move it. Use the economic calendar to watch for key events that signal economic growth or slowdowns. For example, if a positive economic report is expected, it might be a good time to invest in stocks or mutual funds. Conversely, if a downturn is predicted, securing your money in safer assets like bonds or savings accounts could be smarter.

Saving During Economic Highs and Lows

Economic cycles can impact the value of your money. During economic highs, it might be tempting to spend, but it’s also a prime time to save or invest, as higher interest rates can increase savings returns. During lows, focus on building an emergency fund. The economic calendar can alert you to these cycles, helping you decide when to tighten the belt and when to expand your investments.

Planning Major Purchases

The economic calendar can be a great tool for planning big buys. If you’re eyeing a major purchase like a car or a home, track indicators such as inflation rates and consumer confidence. A dip in these might indicate lower prices, making it a favorable time to buy.

Essential Resources for Tracking Financial Events

To effectively track and utilize the economic calendar, you’ll need the right tools. Here are some resources that can help:

- Economic Calendar Apps: Look for apps that alert you to significant economic events. Some popular options include Investing.com’s economic calendar app and the Forex Factory app.

- Financial News Websites: Websites like Bloomberg and CNBC offer up-to-date economic calendars along with expert analyses.

- Broker Platforms: If you invest through a broker, many offer built-in economic calendars with event reminders tailored to your portfolio.

By leveraging these tools, you can keep a pulse on economic trends and adjust your financial strategy accordingly.

A Fresh Perspective on Savings

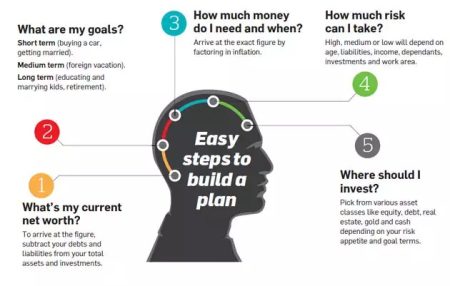

Take a moment to review your financial goals at least once a year. How have economic events affected your savings? Could changes in economic policies impact your future plans? This annual check-in will help you stay aligned with your long-term financial objectives.

Finally, while the economic calendar provides insights, it’s also important to prepare for the unexpected. Diversify your investments to protect against market volatility. Think of your financial strategy as a dynamic plan that evolves with economic conditions, ensuring you’re always positioned to capitalize on opportunities or shield yourself from sudden economic shifts.

By understanding and using these strategies, you can turn the economic calendar from a mere informational tool into a cornerstone of your financial planning.