Freelancers in the vibrant world of entertainment deal with the exhilarating yet unpredictable nature of their income streams. From actors and directors to writers and producers, managing financial obligations, especially taxes, can often seem like a daunting task. Yet, with the right strategies and tools, such as the use of a check stubs generator, freelancers can navigate these waters with confidence. This guide aims to shed light on the crucial aspects of income tracking, deductions, and the benefits of integrating smart financial tools into your workflow.

Fine-Tuning Your Tax Strategies

For those in the entertainment industry, freelancing offers the freedom to select projects that resonate with their passions. However, this freedom comes with the responsibility of self-managing taxes, which includes not only paying income tax but also handling self-employment contributions towards Social Security and Medicare.

Income Tracking Precision

The cornerstone of effective tax management is a meticulous approach to tracking your income. With projects often coming from various sources, it’s essential to have a system in place that captures every payment accurately. Modern accounting software or even a well-organized spreadsheet can serve this purpose. Yet, the role of a check stubs generator here cannot be understated.

Leveraging a Check Stubs Generator

For freelancers in the entertainment field, generating a pay stub for each project completed can vastly simplify the tax preparation process. These stubs act as a detailed record of your income, making it easier to report earnings accurately to the IRS. They can also be indispensable when you need to verify your income for loans or housing applications, adding a layer of professionalism to your freelance business operations.

Deduction Maximization

One of the perks of freelancing is the ability to deduct business expenses from your income, thereby reducing your overall tax liability. Expenses can range from equipment purchases and travel costs to home office setups and professional development fees. The key to leveraging these deductions is keeping exhaustive records, including receipts and invoices, which validate your claims and protect you in the event of an audit.

Quarterly Tax Planning

A significant difference between freelancers and traditional employees is the need for freelancers to submit estimated tax payments quarterly. Setting aside a portion of each payment received into a dedicated tax savings account can prevent the end-of-year tax shock and avoid potential penalties.

Additional Proactive Measures

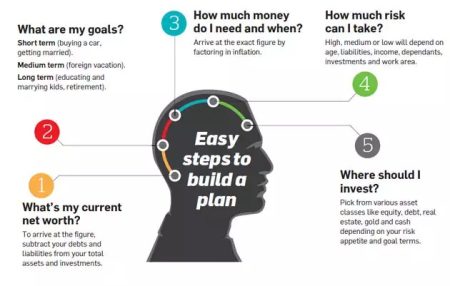

Beyond the basics, there are several strategies freelancers can employ to further secure their financial standing and optimize their tax situation.

Saving for the Future

Retirement Planning: Freelancers should consider investing in retirement accounts like SEP IRAs or Solo 401(k)s. Contributions reduce taxable income and grow tax-deferred, offering a dual benefit.

Health Savings Accounts (HSAs): For those with high-deductible health plans, HSAs offer a tax-efficient way to save for medical expenses, with contributions being tax-deductible and withdrawals for qualified expenses tax-free.

Embracing Digital Efficiency

Accounting Software: Tools designed for freelancers can automate income and expense tracking, making financial management more straightforward and reducing the chances of errors during tax season.

Digital Receipts: Maintaining a digital archive of receipts can simplify record-keeping for deductions and is crucial for documenting expenses accurately.

Professional Development and Networking

Engagement in Industry Associations: Membership in industry-specific organizations not only aids in networking but also provides access to resources, including those related to tax and financial management tailored for freelancers.

Expert Advice: Regular consultations with a tax professional familiar with the entertainment industry can ensure you’re taking advantage of all applicable deductions and complying with tax laws, potentially saving you significant amounts of money.

Conclusion

Mastering financial management as a freelancer in the entertainment industry requires a blend of diligent income tracking, strategic expense deduction, and the smart use of tools like check stubs generator. By adopting these practices, freelancers can streamline their tax preparation, optimize their financial health, and dedicate more energy to their creative endeavors. Remember, the goal is not just to survive but to thrive financially, turning the challenge of freelance tax management into an opportunity for growth and success.